In the vast sea of finance, where the waters can sometimes get choppy, Borrowell emerges as a lighthouse for Canadians. A financial services company that’s distinctly Canadian, Borrowell’s mission is as clear as the northern sky: to empower individuals to take control of their financial health by providing them with the tools, resources, and confidence needed to thrive. Since its inception, Borrowell has been a trailblazer, being the first in Canada to offer free credit scores. Now, with over 3 million members, it’s evident that Borrowell is not just a service but a financial companion for countless Canadians.

A Beacon of Financial Empowerment

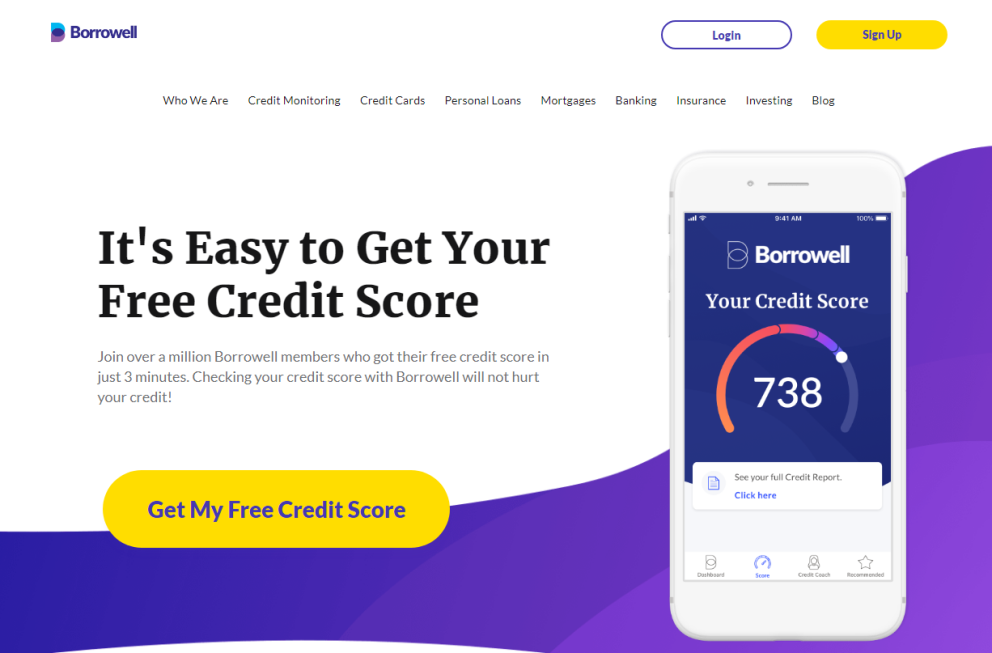

Borrowell’s suite of offerings is designed with one goal in mind: financial empowerment. By providing free access to credit scores and reports, coupled with weekly updates and personalized tips, Borrowell demystifies the credit landscape for Canadians, making financial goals more attainable and less intimidating.

The Core of Borrowell: Free Credit Scores and Reports

Au cœur de la Borrowell’s innovative platform is the provision of free credit scores and reports. This foundational service not only helps Canadians understand where they stand credit-wise but also educates them on how to improve their financial health. Borrowell ensures that checking your credit score with them will not hurt it, a concern that often deters individuals from staying on top of their credit status.

Beyond Scores: A Comprehensive Financial Toolkit

Borrowell’s ambition to be more than just a credit score provider is evident in its comprehensive range of services. From personalized financial product recommendations to AI-powered credit coaching, Borrowell equips its members with a plethora of tools and resources. These offerings are designed to navigate various financial landscapes, whether seeking a loan, credit card, mortgage, or simply aiming to enhance financial literacy.

Why Canadians Trust Borrowell

With bank-level security, tailored financial product recommendations, and a wealth of free educational resources, it’s no wonder that Borrowell has garnered the trust of 3 million Canadians. Here are the top reasons why Borrowell stands out:

- Weekly Credit Monitoring: Free, regular updates on your credit score keep you informed and in control.

- 256-Bit Encryption Security: Ensuring your information is safe and secure.

- Personalized Financial Recommendations: Borrowell’s algorithm suggests financial products from over 50 partners that match your credit profile.

- Credit Education: From tips on improving your credit score to understanding your report, Borrowell educates Canadians on all things credit.

- No Impact on Your Score: Checking your score with Borrowell won’t hurt it, encouraging regular monitoring without fear.

Bridging the Gap to Your Financial Goals

Borrowell does more than just monitor your credit; it acts as a bridge to your financial goals. Whether you’re aiming to secure a loan, find the perfect credit card, or scout for competitive mortgage rates, Borrowell’s tailored recommendations pave the way. Their commitment to being a holistic financial ally is further solidified by their partnerships with trusted financial institutions, ensuring that members have access to the best products on the market.

Financial Wellness at Your Fingertips

In an age where technology reigns supreme, Borrowell harnesses the power of innovation to make financial wellness accessible. With features like AI-powered credit coaching and a user-friendly interface, Borrowell simplifies the complex world of finance, making it approachable and understandable for everyone.

Your Financial Journey, Enhanced by Borrowell

Borrowell stands as a testament to the power of innovation, education, and personal empowerment in the realm of personal finance. By providing Canadians with the tools, knowledge, and confidence to navigate their financial journey, Borrowell isn’t just a company; it’s a partner in financial wellness. Whether you’re taking your first steps towards understanding your credit, aiming to improve your financial health, or searching for the best financial products, Borrowell lights the way to a brighter financial future.