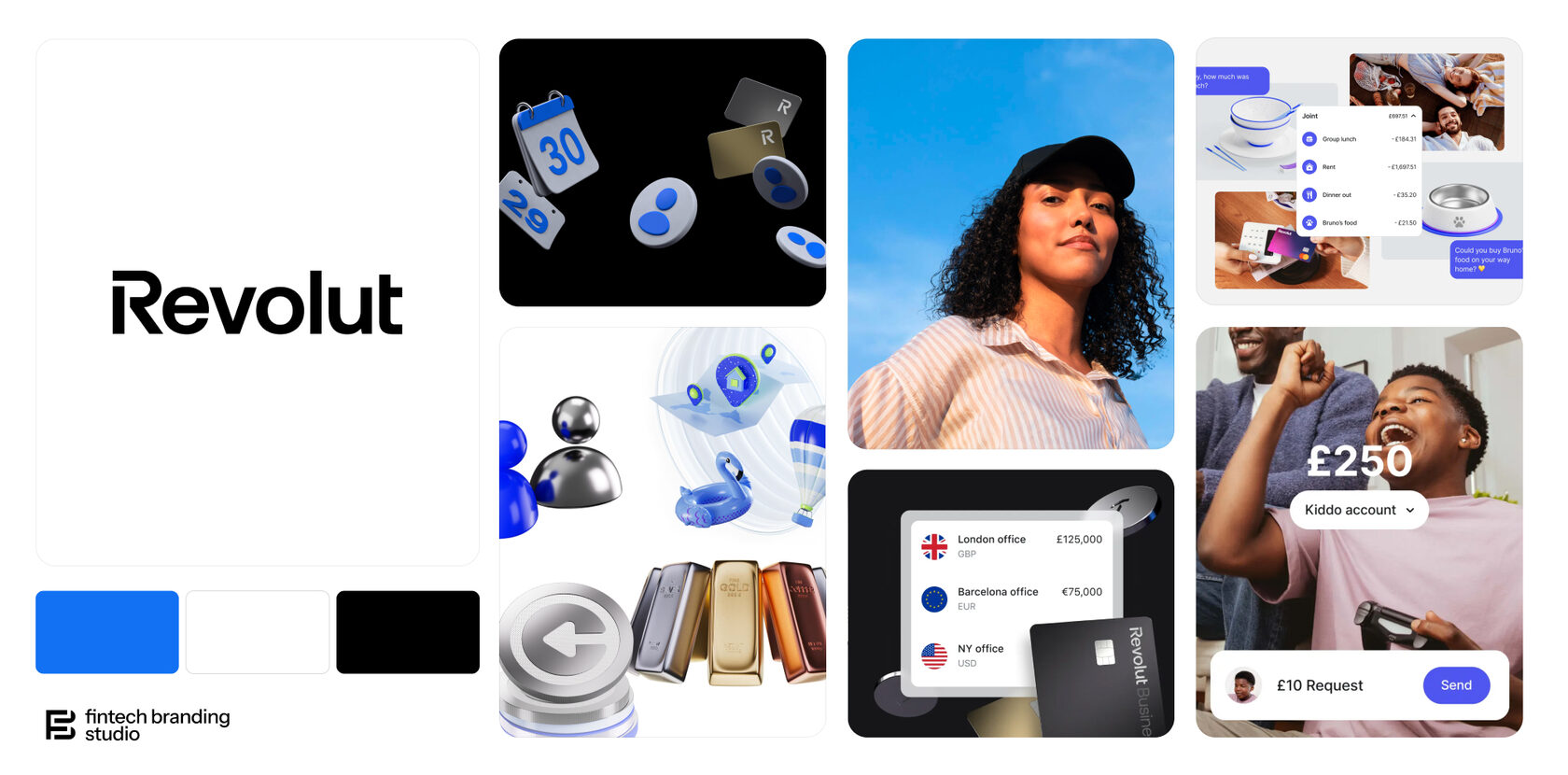

Revolut didn’t just disrupt the financial industry—they completely flipped the narrative on how we think about money. What started in 2015 as a way to avoid insane foreign exchange fees has now grown into a full-force lifestyle tool—digital banking, budgeting, investing, saving, insuring, all packed into one app and several sleek card designs.

But here’s what makes Revolut B2C a standout—it’s not banking for bankers. It’s banking for everyone else. For travelers. Tech lovers. Freelancers. Parents. Dreamers. Budgeters. People who want more control and fewer excuses. Service without branches, fees without the fine print, and updates that actually excite you??? Yeah, this is not your grandma’s savings account.

Simplifying the Complex: One App to Rule Them All

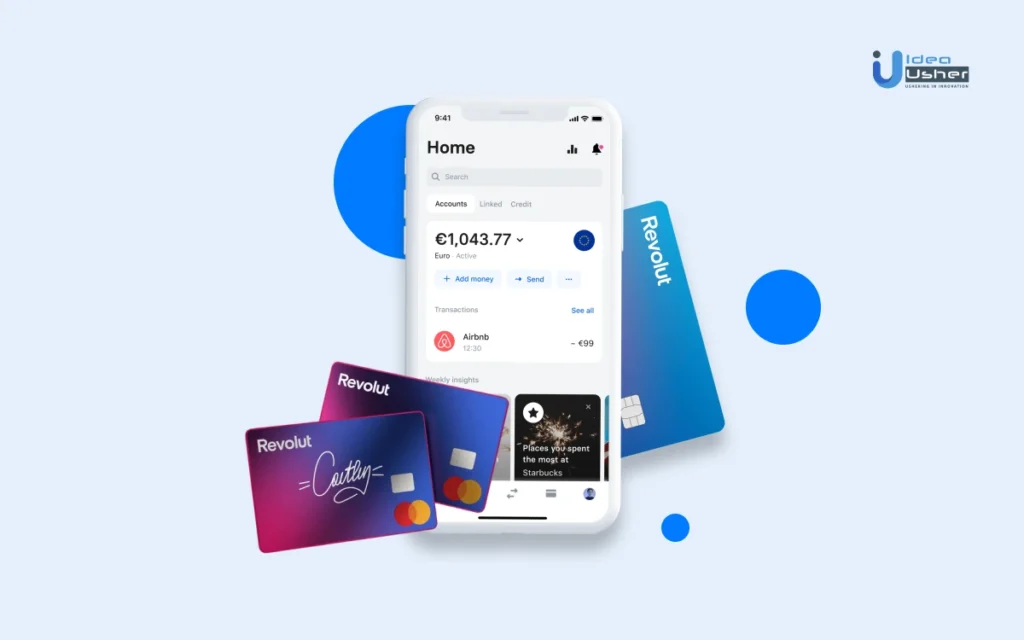

Revolut offers one of the cleanest, smartest, and most beautifully designed interfaces in the financial world. The layout alone is worth its own shoutout—spend tracking, savings vaults, currency exchanges, and investments all arranged in a way that makes total sense without needing a degree in finance.

Gone are the days of switching between eight apps just to manage your buying, budgeting, and travel plans. With Revolut, it’s all built in. Want to freeze your card instantly if something feels off? Tap. Need to split the dinner bill with friends abroad? Done. Want to stash away coins when you make a coffee purchase? There’s a vault for that.

They’ve made managing money feel less like a chore and more like a power move.

Cards That Match Your Style and Lifestyle

Revolut doesn’t mess around when it comes to plastic—or, more accurately, metal. Their Metal card plan has become something of a style icon in the fintech world. Heavy, minimal, sleek—it’s a statement. But it’s more than just looks. You get cashback in multiple currencies, airport lounge access, and concierge service that makes your weekend getaway that much smoother.

For the more budget-minded, there’s the Standard plan (totally free), and middle-ground options like Plusand Premium, which offer layered perks like smart budgeting tools, travel insurance, higher fee-free currency exchange limits, and priority customer support. It’s banking with personality—and flexibility.

Plus, you get virtual cards, disposable cards, contactless payments, and easy Apple Pay or Google Pay integration. Fast, fluid, and fancy when you want it to be.

Why Everyone’s Talking About It (Still)

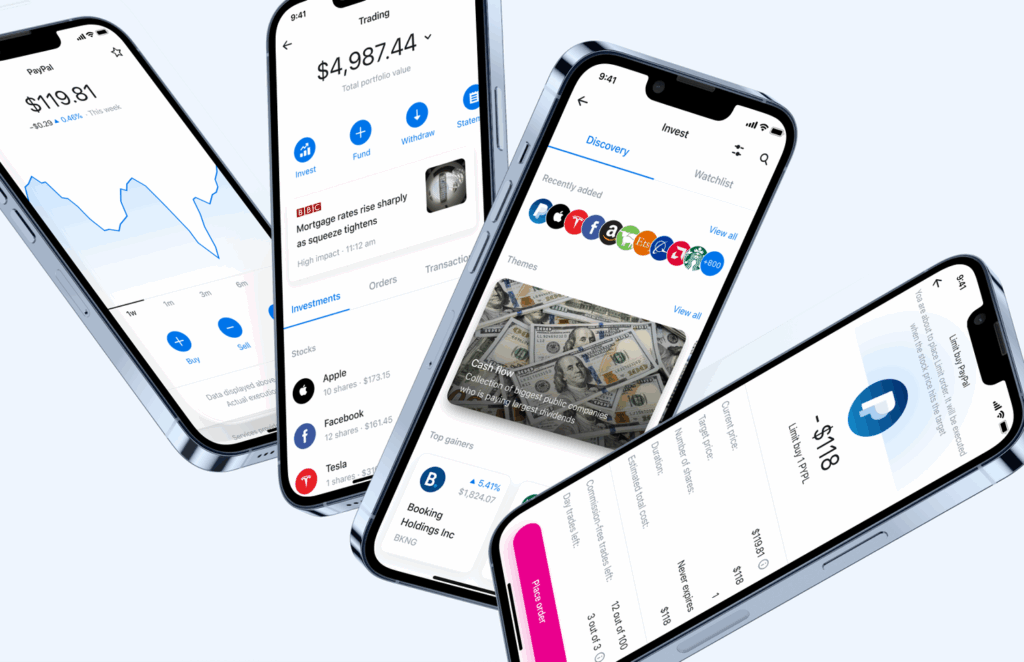

If you think the fintech hype train has passed, think again. Revolut didn’t stop at “cool challenger bank” status—they’ve continued to stack features faster than competitors can read the room.

Their daily analytics break down your spending into hyper-specific useful categories. Their cryptocurrency feature lets you dip a toe into the crypto pool without having to memorize blockchain gas fees. You can invest in stocks directly from your phone with as little as €1. Their Junior accounts teach kids and teens how to handle money early—complete with parental controls.

And now, they’re even pushing into buy-now-pay-later (BNPL) territory, giving PayPal and Klarna a serious side-eye. They’ve also recently started testing rental deposits, travel bookings, and group savings—not to mention partnerships with big names in retail to offer exclusive discounts and card-linked offers.

Revolut is no longer “just an app”—it’s a financial superapp.

Travel Light, Spend Smart

Revolut B2C was built with global explorers in mind—and that DNA is still strong. The app lets you hold, exchange, and transfer money in 30+ currencies with no hidden fees. That dream trip to Italy? You’re booking hotels in Euros, jumping cities with instant in-app metro ticket purchases, and splitting pizza costs in real time with people from five different countries.

There’s overseas medical insurance baked right into some plans. Plus, instant currency updates and fee notifications ensure you don’t get blindsided while replacing a lost swimsuit in Greece—or grabbing lattes in Lisbon.

You also get access to discounted airport lounges if delays strike (and let’s be real, they always do), and in some cases, you can even rent a car or book an experience directly through the app.

No more currency confusion, endless bank fees, or mailing debit card replacements to another continent. Revolut travels like you do—light and low-maintenance.

Community Power + Real-Time Support

True to its tech roots, Revolut also has one of the smartest communities around. User-driven forums, fast Reddit FAQs, a feature request wall that often gets implemented—there’s a constant feedback loop that makes the platform feel constantly evolving.

Need help at 2am because you heard a ping from Croatia that might be fraud? Revolut’s live chat is there. Premium plans get even faster response times, but even Standard users report clear, no-bots-needed help usually within minutes.

And speaking of security—they’re rock solid. End-to-end encryption, custom pin limits, geographic card protection, and instant freezing of accounts if anything weird pops up. Finance is stressful. Revolut helps that feeling press pause.

Saving Without the Heavy Lifting

Revolut’s Vaults are a fan favorite for a reason. Want to round up your spare change and save toward a splashy staycation or a new phone? Child’s play. Need to automatically transfer a small sum every week to build up an emergency fund? Set it and forget it.

Users can create group vaults for shared goals (think friend trips, bridal party budgets, or even roommate bills), and you can also save in multiple currencies—including crypto if you’re feeling good about Bitcoin this season.

The platform even offers interest-earning savings vaults, so your money doesn’t sit there quietly doing nothing. Passive growth while you sip coffee and scroll social media? We’re here for it.

A Smart Fit for Freelancers and Digital Natives

You don’t clock in 9-to-5? Revolut gets that, and their B2C tools reflect the chaotic, creative, and hybrid lifestyles of freelancers and online workers. You can receive payments from abroad, issue payment links or QR codes, and manage recurring billings like a low-key CFO.

And if you’re juggling currencies because your client’s in Berlin while you’re in Barcelona—no stress. Multicurrency accounts and cross-border transfers are fast, basically fee-free, and ridiculously simple.

Some personal users even migrate to Revolut Business later, especially once they scale up or launch side hustles. But for solo lifestyle management on a personal account, B2C is smooth and sophisticated enough to handle all the chaos and cashflow with class.

A Fintech Icon That Keeps Getting Better

There’s something so satisfying about watching a brand grow with you. Revolut users who joined five years ago have seen the app evolve from minimalist travel card to wealth manager, lifestyle fixer, and full-on household finance partner.

It’s bold, clean, and deeply intuitive. And while traditional banks are still trying to fix their outdated apps or roll out “new-gen” updates with two-year timelines, Revolut moves like your favorite tech brand—fast, always improving, and rarely boring.

Whether you’re budgeting better, investing smarter, or just making international travel less financially painful, Revolut B2C is the pocket-sized lifestyle tool everyone should have in 2024 and beyond.